Job Credits and Opportunities for Students

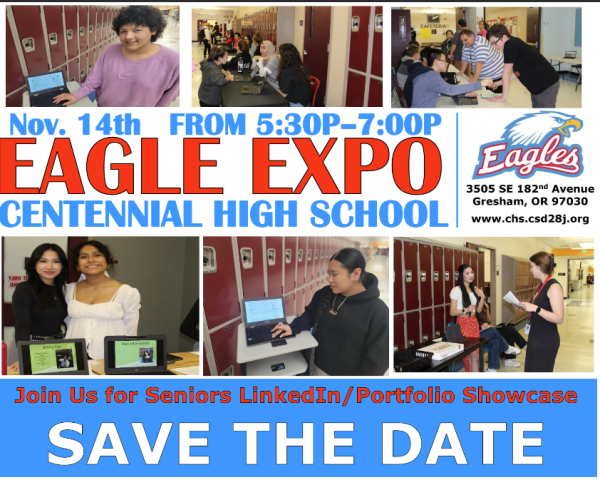

I sat down for an interview with Mr. Henderson, the school to career specialist, at Centennial High School. We talked about some job opportunities and credits you can earn outside of campus.

The first question I asked him was how does getting credits for job hours work?

“It’s really simple, there’s a paper you fill out which tells us where you work, you get a parent or guardian to sign it and turn it in to me. After that they would have to show proof, whether that’s a pay stub or an app which shows their pay,” said Henderson.

90 hours of work gets you 0.5 of an elective credit, for a maximum of 2.0 credits which would be 360 hours worked.

“Any student can benefit from it, but especially this year when students have maybe had a rougher time in distance learning, seniors, and even some juniors who are looking ahead and need some more credits to graduate. If some students’ regular class schedule is full of requirements now, they need to find a way to get elective credits. This helps out any student who fell behind for various reasons. There are also plenty of students who aren’t behind, they just want more credits on their transcript to show they’ve done something extra outside of school,” Henderson says.

Another question I asked Henderson was, what are some job opportunities nearby?

“I’ll get contacted from time to time with companies that say they’re hiring and I’ll take that information and post it on the job board so everyone can see it. They aren’t super consistent but recently Wendy’s and Panda Express reached out, those are some that are nearby, but it’s either a hit or miss sometimes there’s more and sometimes there’s less,” Henderson said.

Next I asked what opportunities he recommended.

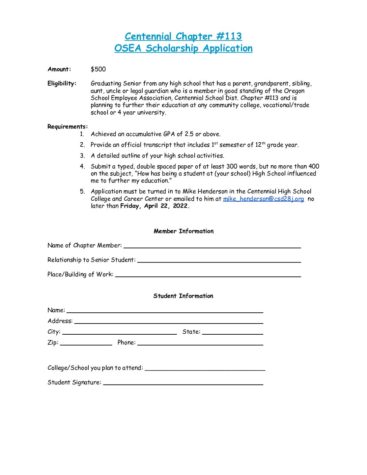

“I’m hoping the seniors are taking advantage of applying for scholarships because a lot of the deadlines are coming up soon. This maybe isn’t an opportunity but to get the chance to fill out your FAFSA or ORSA financial aid because anybody who’s thinking of going to any level of college should apply for financial aid. Those are probably the biggest things I would recommend students are doing right now,” Henderson stated.

Lastly I asked Henderson about what students can do to help with the cost of school.

“The best thing is to start with either FAFA or ORSA, to see, based on your family’s need, are you going to get direct aid that you don’t need to pay back from the federal government. Or to see if you can also get aid in loan form that you have to pay back but it helps you get there. FAFSA can also prove a work study for you which is where you have a job while you’re in college working on campus, they can potentially give you a job at that school making money that goes directly towards tuition. Then once FAFSA or your ORSA is done no matter who the student is, I recommend they apply for Oregon Promise because although that’s for community colleges if you plan on going to a four year university and then that changes, it would be too late past the deadline to apply for Oregon Promise. Once those things are done I would work on scholarship opportunities. There are many you can apply for that would help. Obviously getting a job right now if you don’t have one and save some of the earnings to go into school,” Henderson exclaimed.